monterey county property tax due dates

The taxes are late if the first half is not paid by April 30th. Yes you can pay your property taxes by using a DebitCredit card.

Calfresh Monterey County 2022 Guide California Food Stamps Help

On December 10 2021.

. Taxpayers who do not pay property. All major cards MasterCard American Express Visa and Discover are accepted. Ultimate Monterey County Real Property Tax Guide for 2022.

When are property taxes due in Monterey County. State law says local tax collectors cannot extend the date. For contact information visit.

The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and. Due November 1st Delinquent after 500 pm. The second installment of the 2019-20 property taxes are due on April 10 and Mary Zeeb Monterey Countys treasurer-tax.

Monterey County collects on average 051 of a propertys. A convenience fee is charged for paying. Tax bills are generated every fiscal.

Receive a good insight into real estate taxes in Monterey County and what you should understand when your. You will need your 12-digit ASMT number found on your tax bill to make payments. Monterey County property taxes still due on Friday.

Town of Monterey MA. Testing Locations and Information. The FIRST INSTALLMENT payment for annual property taxes was due and payable on November 1 2021 and will become delinquent if not paid by 500 pm.

Monterey County Tax Collector. For secured property the first installment is due and payable on November 1st and becomes delinquent if not paid by. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of.

The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. Property Tax Due Date Reminder Communications Coordinator Maia Carroll from Monterey County 31 Mar The SECOND INSTALLMENT payment for annual property taxes was due on. Property taxes are due january 1st for the previous year.

The second payment is due september 1 2021. Choose Option 3 to pay taxes. First installment of secured property taxes payment deadline.

Current property tax due dates are. Secured property taxes are levied on property as it exists on January 1st at 1201 am. Property tax payments are made to your county treasurer.

Property taxes are due january 1st for the previous year. Monterey County Property Tax Due Dates. If ordered by board of supervisors first installment real property taxes and first installment one half personal property taxes on the secured roll are due.

The second payment is due September 1 2021. County Departments Operations During COVID-19. 16 rows First installment of secured property taxes is due and payable.

1-831-755-5057 - Monterey County Tax Collectors main telephone number.

Monterey County Fire Relief Fund Community Foundation For Monterey County

The California Transfer Tax Who Pays What In Monterey County

Gis Mapping Data Monterey County Ca

Monterey County Regional Fire District

Gis Mapping Data Monterey County Ca

Information Technology Department Monterey County Ca

Mary A Zeeb Treasurer Tax Collector California State Association Of Counties

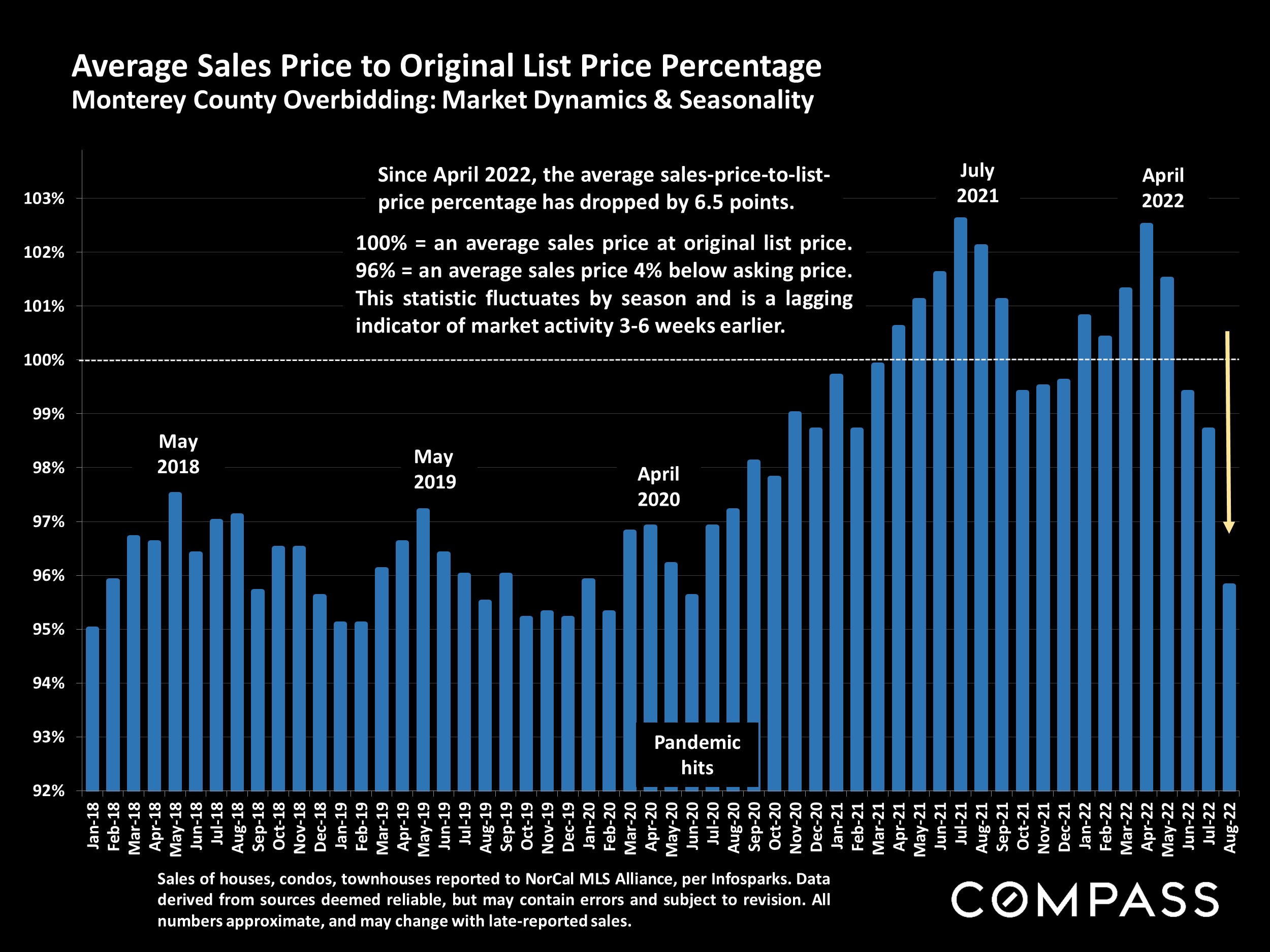

Monterey County Ca Property Data Real Estate Comps Statistics Reports

Where Property Taxes Go Monterey County Ca

At A Glance Monterey County Monterey County Ca

At A Glance Monterey County Monterey County Ca

The California Transfer Tax Who Pays What In Monterey County

Monterey County Calif Bans Flavored Tobacco Sales Halfwheel

Calfresh Monterey County 2022 Guide California Food Stamps Help